Glossary

Book value: The value of a company if it were to be liquidated (Assets - Liabilities)

Goodwill: In our context goodwill refers to difference between the paper valuation of a company and the cash out the door to pay for it. If an acquiring companies pays $2M in cash for a $10M company it will create an $8M goodwill 'asset' on the acquriing companies balance sheet.

Background

What we we will do is create a simplified but representative model of Silicon Valley, we then create a reasonable attack mechanism that uses a combination of money and social engineering to destroy it. We will also surface some data showing that, at least at a macro level, the finger prints of an attack are present.

This attack mechanism is sufficiently descriptive of what we have seen in the Valley and Tech over the last 5-7 years and what we currently see in the valley today.

While we can’t definitely say it was an attack what we can say is we can’t rule out an attack, we can also be fairly certain the gaps in controls in this system have effectively destroyed hundreds of billions in cash which was spent on salaries and transaction fees leaving as much as a trillion dollars in book value sitting on corporate balance sheets as goodwill.

Basis of the Attack

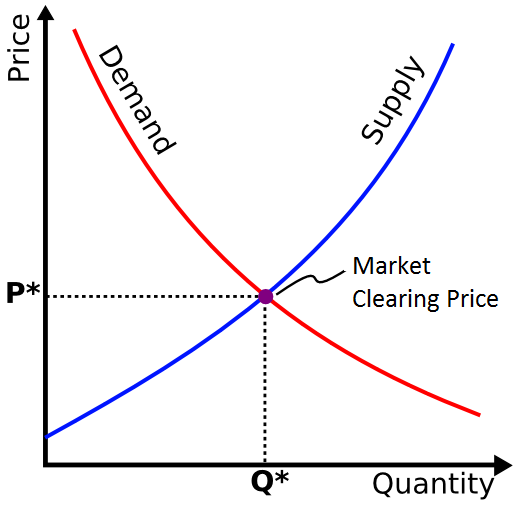

The attack relies on the basic principles of supply and demand, all systems have a natural equilibrium, in economics this is defined in terms of the market clearing price. As systems grow naturally, supply and demand will change over time and the market clearing price will change. When you artificially manipulate either factor the behavior of the system will change, for example increasing the supply of venture capital funds (number), you increase competition to meet the demand for funding (startups). This will, among other things, artificially drive valuations higher for those startups and it will increase the throughput through the system (faster time to fund driven by competition). Alternatively, increasing the demand (startups) while not increasing the supply (venture capital funds) will result in throughput through the system falling and valuations falling along with it. Note: there is likely an asymmetry with how easily valuations rise vs how hard they are to decrease.

The theoretical attack

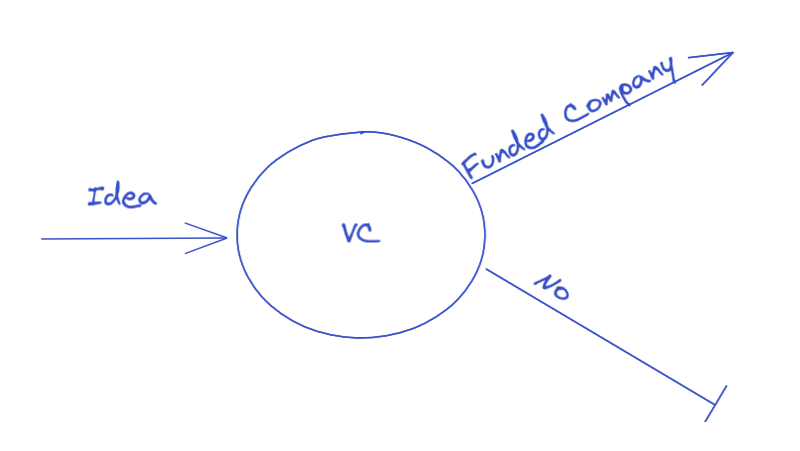

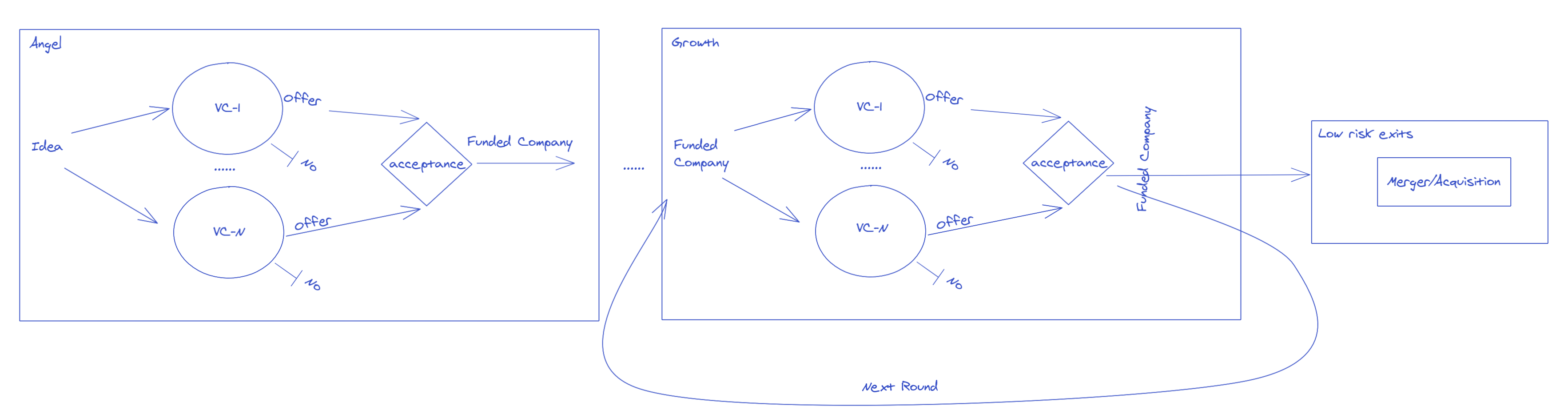

If you think about the valley as a sub-system one that takes inputs (ideas) and produces outputs (funded company). The funding decision is ultimately binary, yes/no. A single round would look like this.

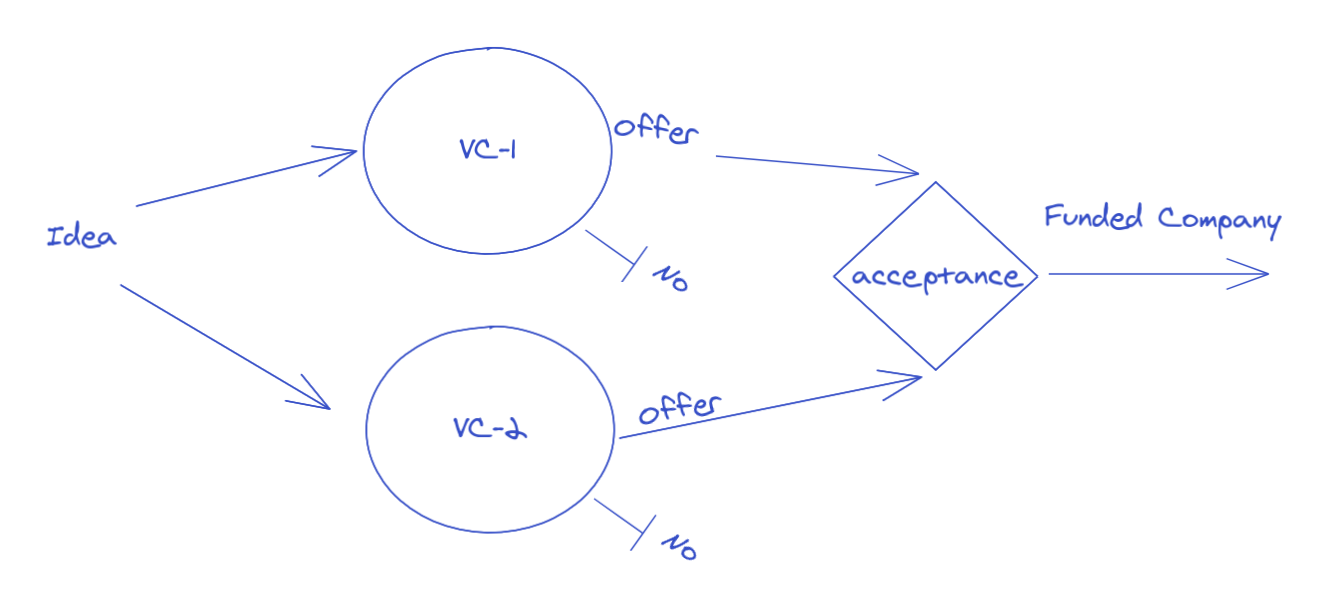

If you have more than one VC in the system it looks more like this:

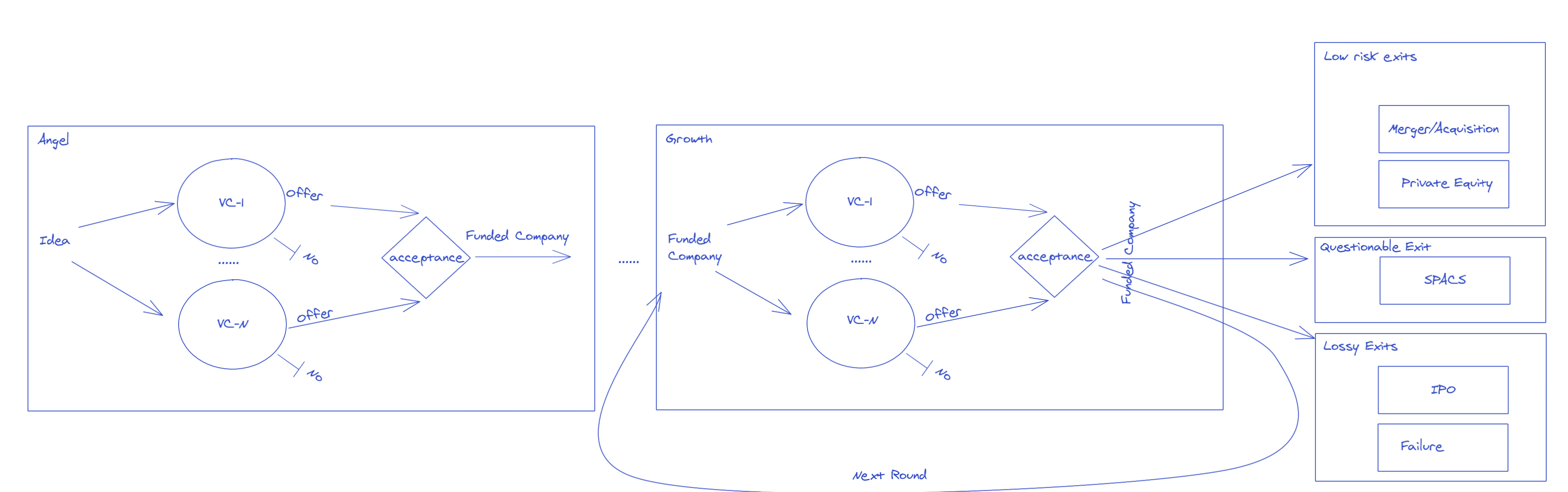

It gets more interesting when you have more than one round, you could generally approximate it like this:

If we define an Idea simply as a company name, a description of the idea and a proposed valuation, the VC nodes will return a rejection or a proposed offer at which point it gets accepted. Once the offer is accepted the proposed valuation now becomes the new base valuation for the next round. This keeps going until one of the exit conditions happens.

Some basic rules for the system:

Every round dilutes all the previous rounds the more the value increases the more significant the dilutions are to the previous investors.

Upon failure the company becomes worth zero, and losses are taken.

For IPOs/SPACs the investors receive new cash from the markets

For Private Equity they receive cash from the partnerships.

For Mergers/Acquisitions, things get interesting,

As the acquiring company I take the difference between the assets of the company and the amount I am paying and create a new Asset on my balance sheet for "Goodwill" (an accounting term).

For the current investors in the company they can receive cash or stock in the acquiring company.

This simple model effectively describes how venture capital works, now let's think about how we could attack this model.

Our attack goal is to create as much book value (goodwill) with as little money and effort as possible. With that defined as our attack we can eliminate every exit except merger/acquisition. Our simplified model now looks like this.

This system on it's own will naturally optimize for book values over time, to expedite and control the process we need to do a couple of things.

To attack this system we would want to take some time and move slow at first to maximize results. We would want to start with increasing the number of VCs in the system, and maintaining and building Captive VCs. A Captive VC is a VC we own or otherwise control and will allow us to provide "successful" exits of any value for our victims.

More VCs will create artificial competition allowing us to drive behaviors we desire, as our targets chase their goals (returns)

Since the Angel round is where we start we are lucky because the number of Angel investors is large and the set of them very dynamic with new names appearing all the time and old names disappearing. So creating new Angel's is easy.

The bootstrap phase

Starting slow with some Angel funds, we need ideas to fund, what better place to get cheap ideas than y-combinator, (early on) these founders also have the added benefit of being gullible and falling for the $50K to skip college idea. We could also fund startup competitions, or things like startup buses.

We can now establish a paper company, to make this easier, we can use Stripe's Atlas API (interestingly was hooked up with Silicon Valley Bank), the more we can automate the easier we make document checks due diligence.

At this point all we would be doing would be building credibility between our Angel and other VCs, the best way to do that would be to ensure they get successful exits when they accept one of our ideas, that means in the beginning these would need to be real enough to pass the initial vetting to get the relationship started. As soon as we have our target VC invested we can now manage the return they will get, success makes friends.

And the easiest way to do this is to either

Invest: make an offer from one of our Captive VCs in the next round (since we own the angel we will know when they start looking, we might even advise them as their Angel to talk to our Captive VC). This offer can be at higher valuations and higher cash amounts (again, our goal isn't longevity it's to build trust between the Captive VC and the targeted VC). We also have a competitive advantage as we will likely have access to the other term sheets.

Acquire: buy it outright with another paper company.

During this phase the cost per company is relatively high, maybe we do a generous

We could do this cheaper by buying the company sooner for less, having the Angel take more ownership, or lowering the valuation (at a $30M valuation the VC gets a 10x).

We also get to keep whatever cash is remaining, so our cost to run the cycle winds up being salaries and overhead and the amount we have to payout to the other owners, (services like WeWork help reduce the costs and increase our automation capabilities). In the meantime we have created $50M in book value for a 130% paper return.

The pressure phase

As our Angel and Captive VCs are building credibility in the network, we would want to start to increase pressure on the system to move faster.

To do this we start increasing the rate that we add new Captive VCs to the system with more Captive's we have more flexibility to introduce new mechanisms to optimize our attack, such as successful funding paths that exclude any targeted VCs. We also start building analysts with strong track records (they don't even have any idea what's actually happening). The opportunity to exclude targeted VCs puts them in a position where they feel like they have to start fighting for deals.

This would also be a good time to start creating social pressure, we can do this with some helpful social media manipulation, we tell the stories of all the no’s that were home runs (e.g. the Google), make folks question the value of process and due diligence, a sense of urgency is a very powerful tool to create process blindness.

As our bootstrap phase continues, the pressure to say yes increases as a result of the artificial path that always pays off if it is one of our ideas. This path will be evident in individuals in the targeted VCs delivering better results than their peers. This has the side effect of exacerbating the Dunning–Kruger effect within the targeted VCs, which will make it easier for us over time as less qualified 'yesers' are rewarded for their returns while due diligence and saying no are penalized.

We can start forcing the reduction in due diligence by leveraging our Captive VCs and reducing due-diligence requirements and other time consuming process points during a round. Naturally, we can use our social media manipulation to talk about this breathlessly which will increase the pressure to drop these requirements making it more of the norm (note for the VCs to do this they would need to use money not subject to the partnership agreements, helpfully banks like Silicon Valley Bank loaned against partnership assets).

For founders, the ease of Angel funding and what appears to be rapid growth funding will attract more Ideas creating more volume in the system creating additional beneficial pressures and allowing us to hide in the traffic.

Scaling up

At this point we can just start printing companies and routing them through the system, we want to move through quickly but we want to increase the number of rounds as each round lowers out out of pocket cash, we also have the ability to do all stock transactions further reducing the out of pocket costs.

Since we are just printing companies, we wind up creating dislocations in the job market which will drive our costs up, but as an attacker this creates collateral damage as salaries start increasing, since our companies don't care about overhead costs (we are optimizing for book value), the cost for these resources will be raised across the entire economy as we incent founders and engineers to build whatever (the idea doesn't matter only book value) silly thing they think is great taking talent away and raising the costs for companies that are building more valuable products.

This will crowd out real participants as the volume of noise in the system increases and overwhelms everything, given the volume pressure and the time pressure, an Idea only has to be better than the other ideas presented in a time period

Maybe even

If we are successful at creating enough organic activity we could inject another mechanism, the acquire-hire where we just acquire a company to hire the people, essentially creating book value for an HR function.

Game over

When we are finished we just pull your Captive VCs and our Angel VCs. The system will freeze, all book value will be stuck where it is as folks try to figure out what to do.

The VC assets pool will be composed of three tranches of companies

fake companies with zero value

a smaller number of real companies whose real value is zero as there just isn't a market

a small number of valuable companies that are supporting the the rest of the mess.

The valley talent pool will be flooded by low quality highly credentialed people too incompetent to understand what happened or how.

If we are really successful we will induce Corporate America to get in the game both by investing and buying overvalued assets.

Is this what happened in the valley?

This attack looks very much like a description of silicon valley over the last ten years, things get really interesting when you ask this question "what tech products or services do you use or know about from companies started post 2015",

The results are surprising, this is a list of 104 companies which includes

every tech company in the largest 300 companies by market cap

all the tech companies from Wikipedias Internet Companies list

all the tech companies from Wikipedias Software Companies list

the name of company anyone can think of

It zero since 2018... in that same period of time the VC industry shows all the signs of attack (these are from nvca https://nvca.org/wp-content/uploads/2024/05/2024-NVCA-Yearbook.pdf and https://nvca.org/wp-content/uploads/2024/04/2024-YB-data-PDF.pdf )

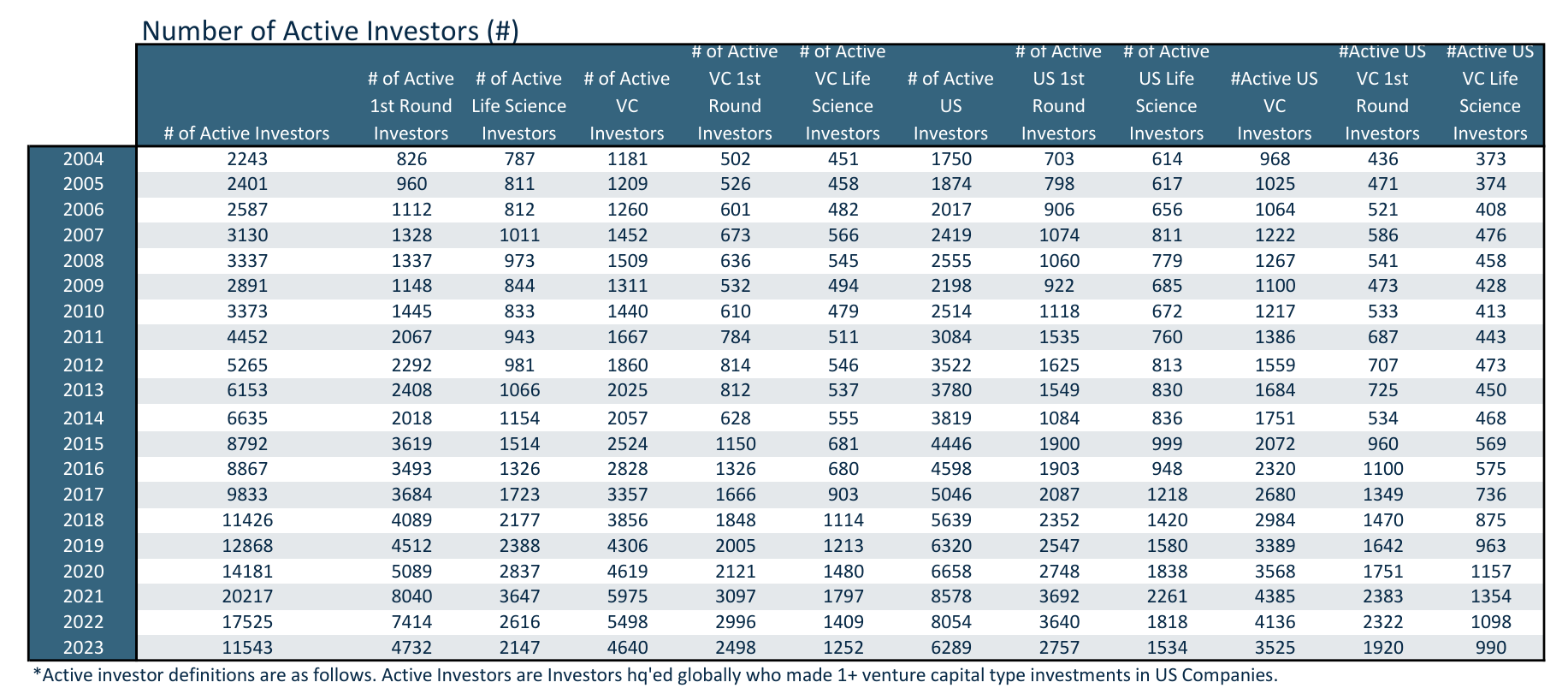

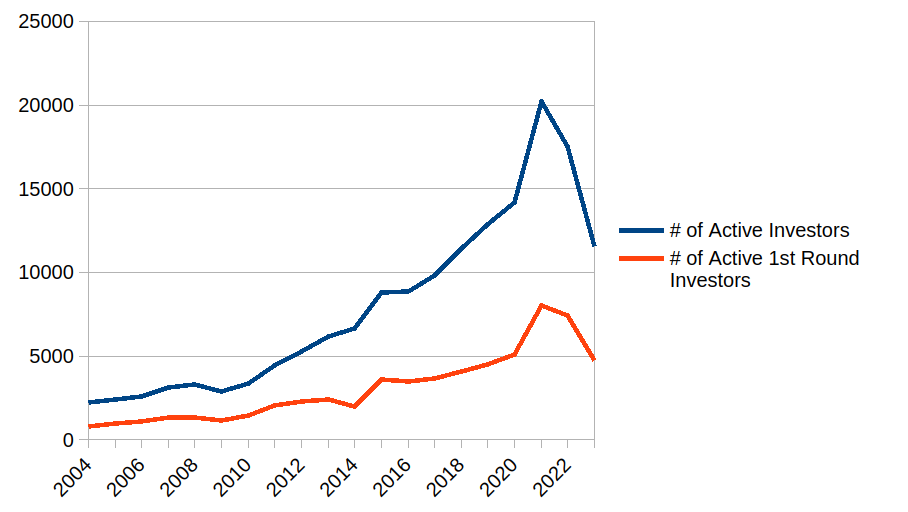

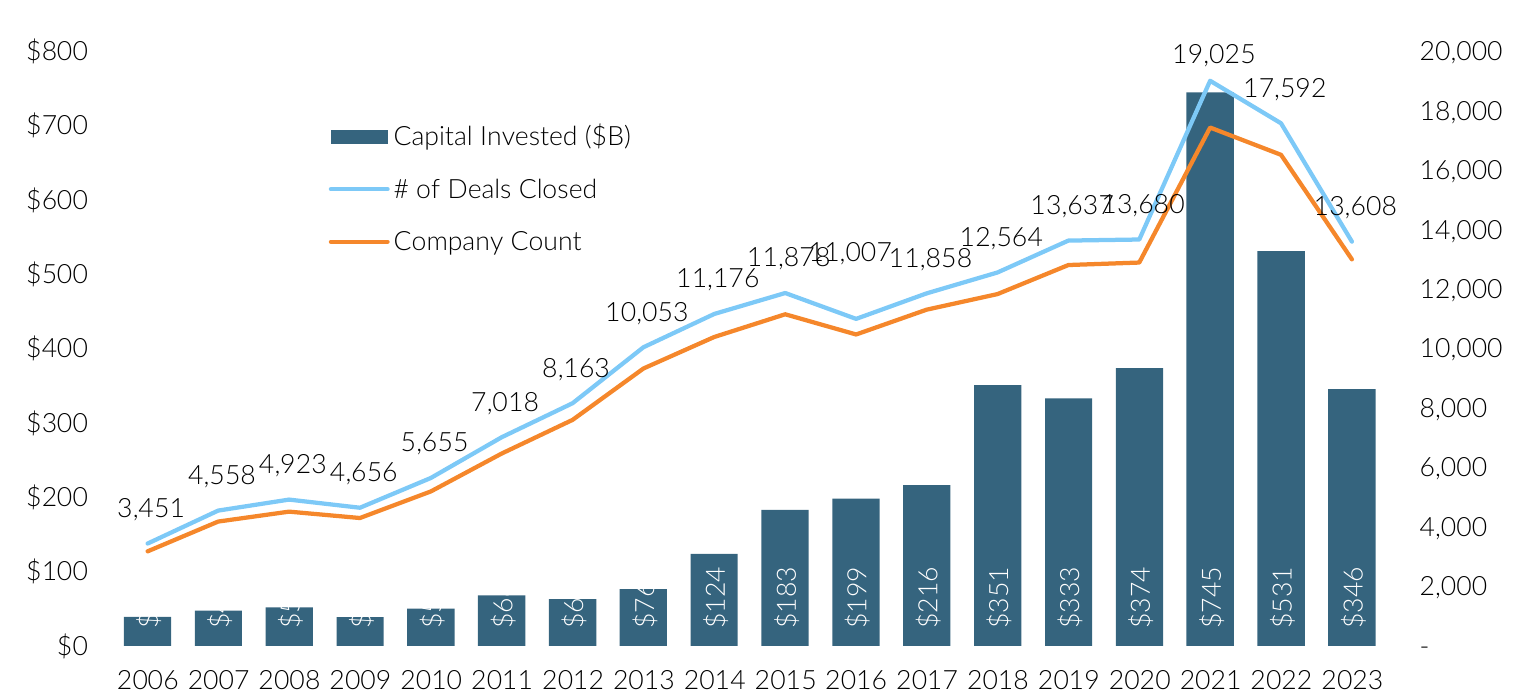

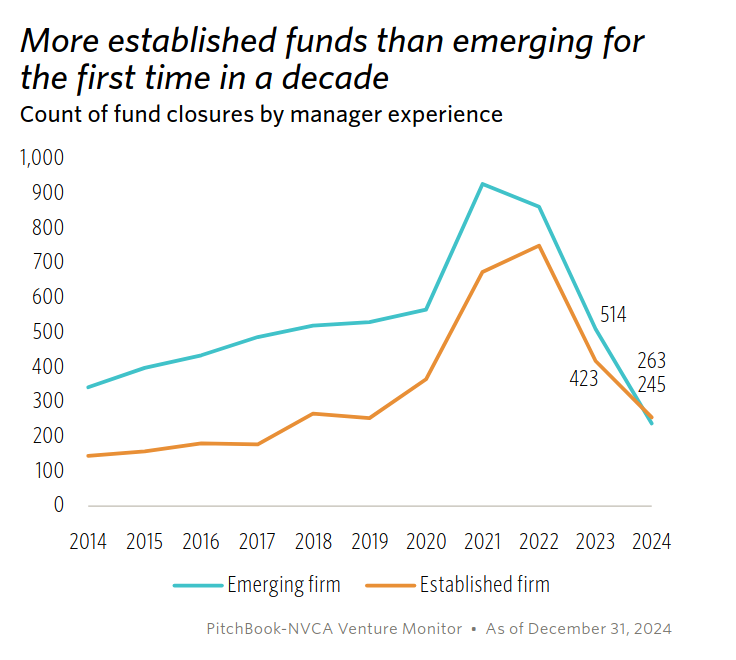

Growth in the number of 'investors'

and a visual

and a visual

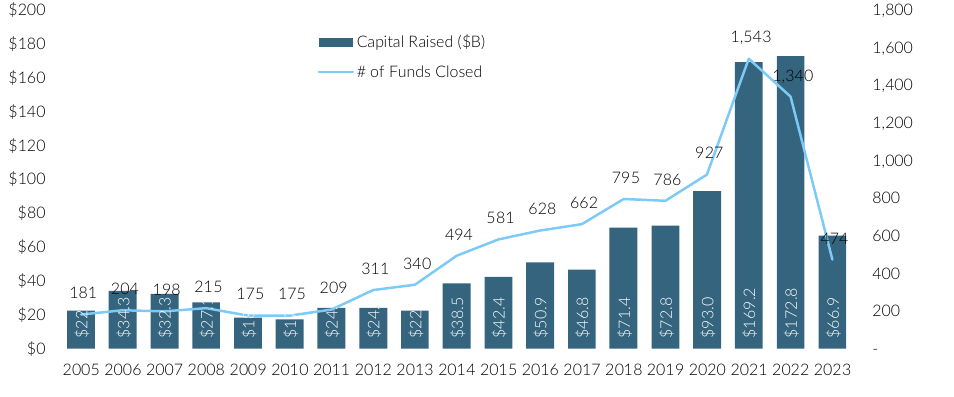

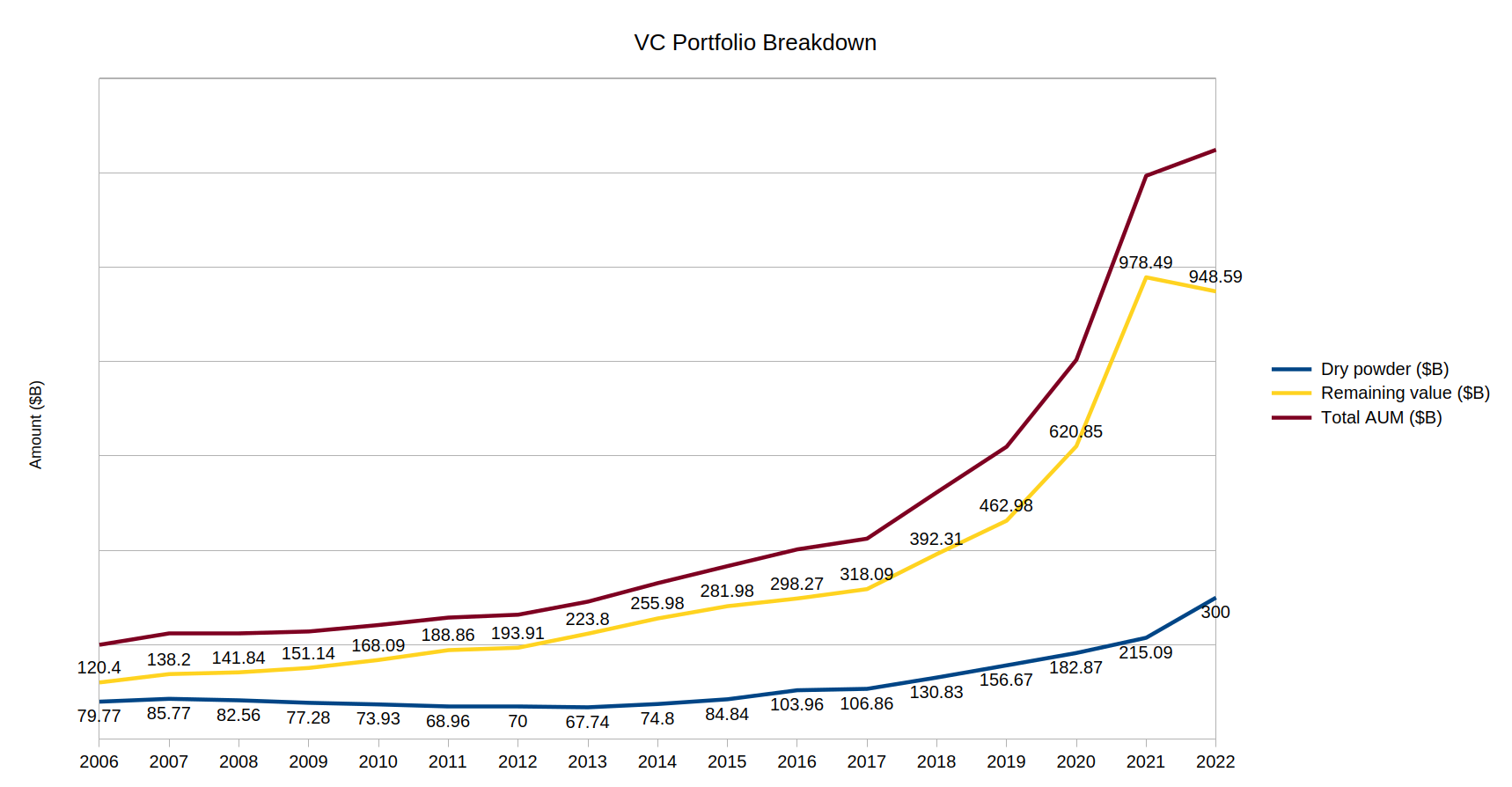

Money flowing into the industry

High transaction volumes:

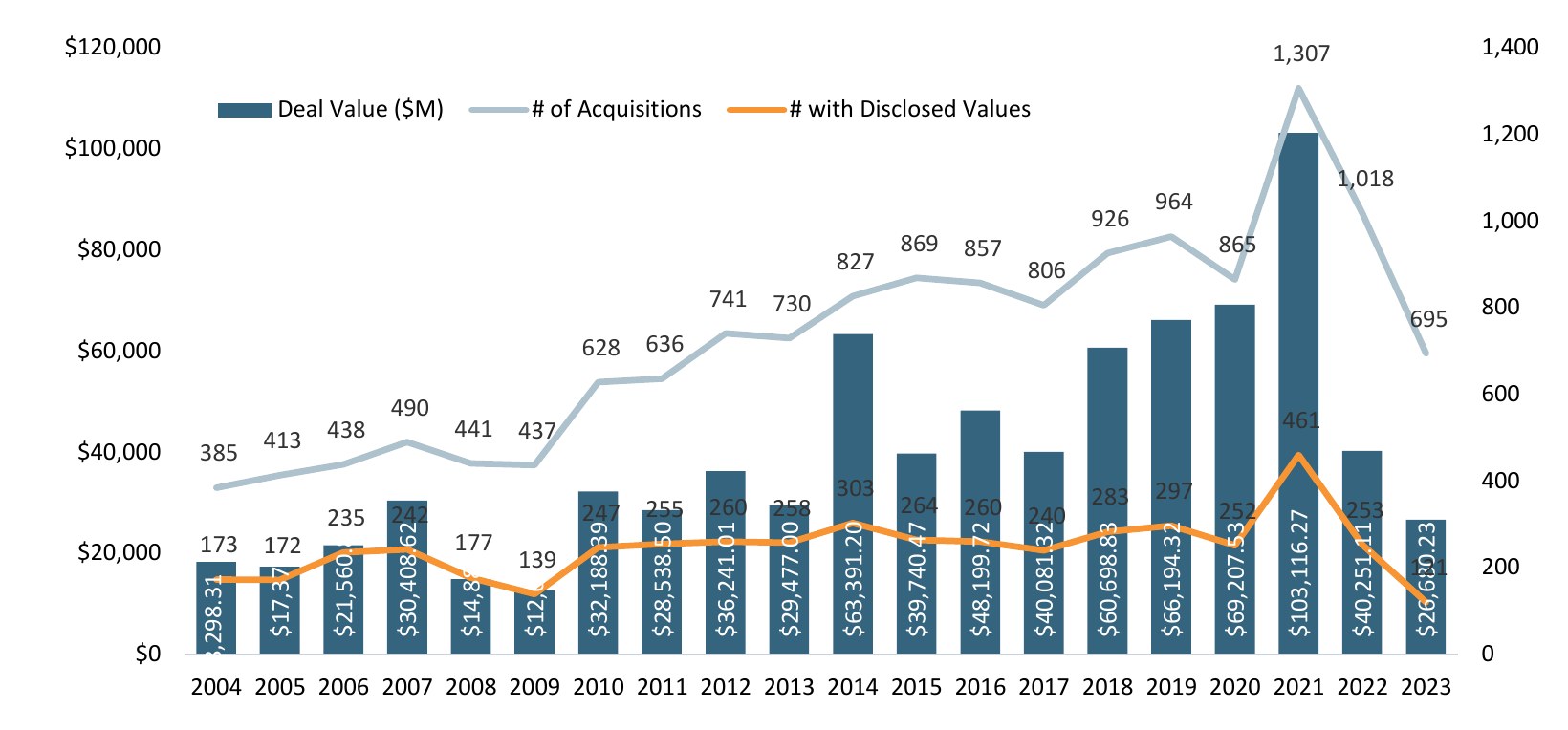

Large volumes of M&A Transactions

The Outcome

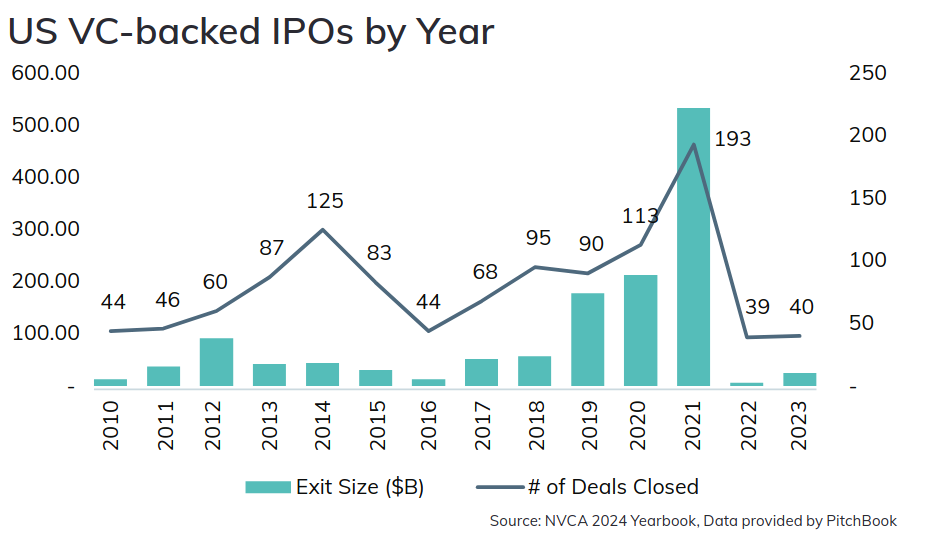

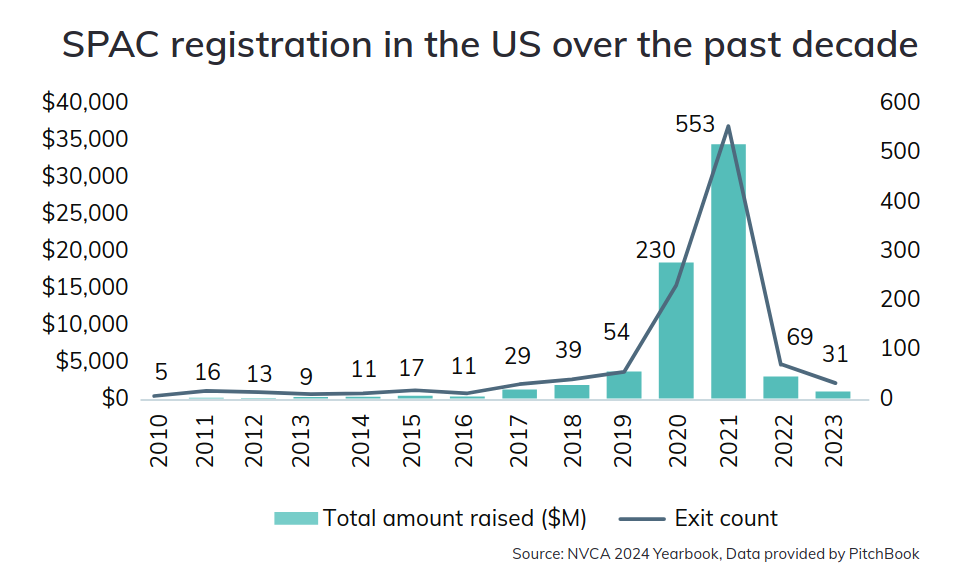

Freezing of exits

IPOs

SPACs

Decline in the number of funding participants

Silicon Valley Bank

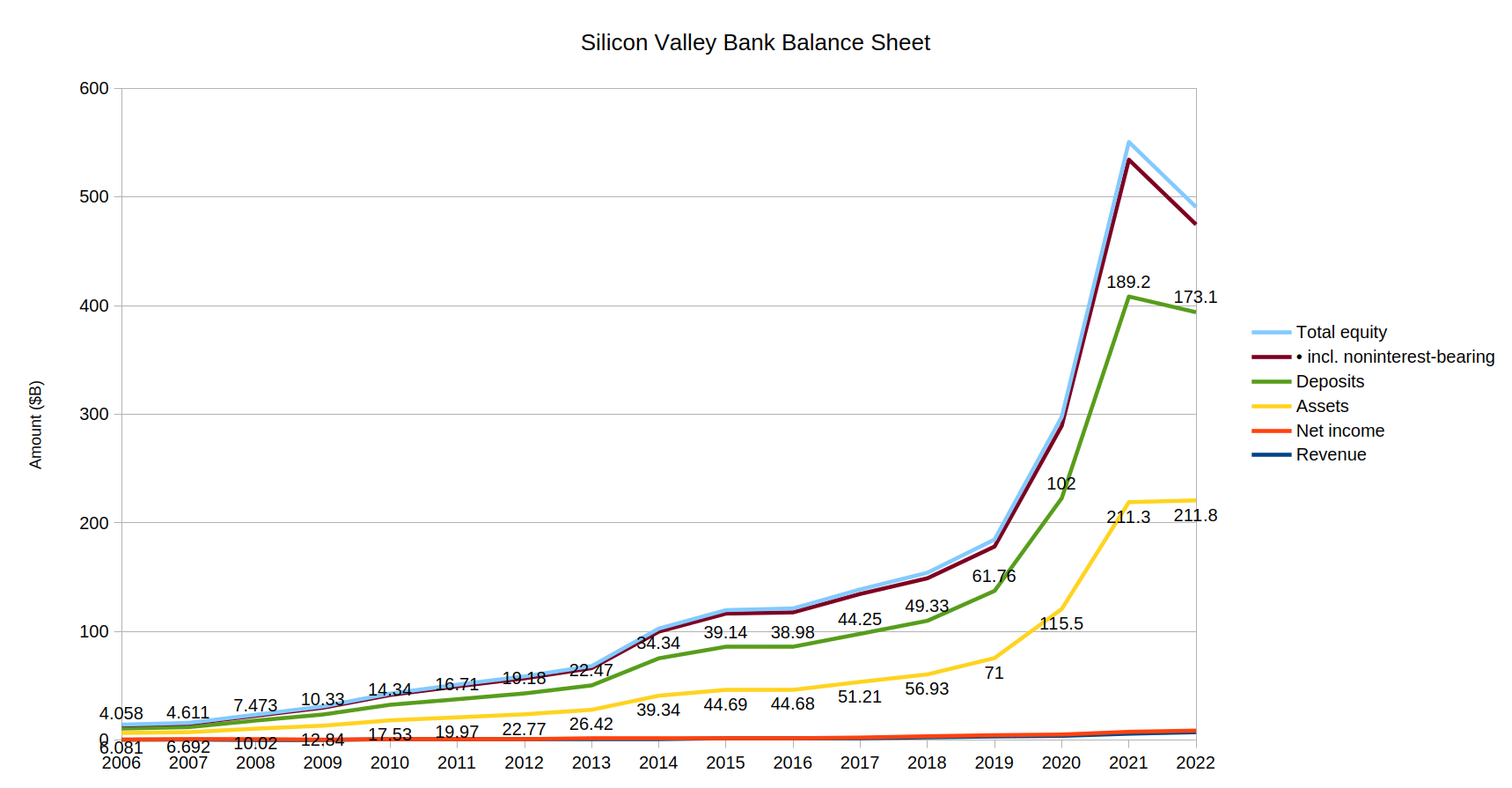

And one last oddity this is Silicon Valley Banks balance sheet

Venture Capital Balance Sheets (SVB supposedly has 65% of the valley banking at it)

The shape of these graphs is surprisingly similar, but is reasonable as SVB claimed to service 65% of the startups in the valley, including most of the top tier VCs. The really interesting artifact is the drop in remaining value, and its correlation to the drop in deposits at SVB. It is interesting because SVB allowed VCs to borrow against the partner funds (creates an asset on the bank balance sheet), if SVB had to call one of those loans and it turned out to be secured by bad investments, you would expect to see assets at the bank to stay the same, deposits to fall (the get surrendered as collateral for the loan) and assets remaining value to fall (book values taken to zero). Which is exactly what we see.

To add to the weirdness, Thiel tried to (and did) trigger a run on SVB (they pulled $45B in a couple of days before the FDIC closed the bank), why would he try to do that? Did he know it was all paper and was trying to kick of it's failure and the implosion of VC? Given his op-ed this doesn't seem implausible.

Were they stealing covid relief cash? Probably

Is that why Musk attacked the Treasury payments system? Who knows, Was he cleaning up his tracks? Again who knows.

The financial hole here could be significant, even if only a small percentage of the companies are fake the dynamics of the system ensure everything else is over valued, if this wild theory is true, this would be catalyst for a market correction and combined with a government that is in shambles basically looks like the collapse of America, in a way the mirrors almost exactly what happened to the soviet union.

Examples

JPMorgan Purchased a startup named Frank at a paper value of $175M, months after the transaction closed a different business group inside of JP Morgan attempted to contact the supposed customers of Frank only to find out they were fake. The founder paid $18K to have someone create four million fake accounts after their engineer declined to fulfill that request for ethical reasons.

If they could figure out the gaps in the system it should pretty easy to believe it could automated or weaponized.

https://www.justice.gov/usao-sdny/pr/former-start-ceo-charged-175-million-fraud

https://finance.yahoo.com/news/jpmorgan-claims-millennial-founder-tricked-121900861.html

Other Indicators

This is just random small alpha stage VC, staring in 2018 these guys were closing a deal a month, which is an impressive clip there’s a lot of crap you have to wade through to find a idea worth writing a check for.

These guys are bigger but holy crap they were doing a deal a day (well really more when adjusting for working days), what is interesting about them is they are a federated model, they take small deposits from many individuals aggregate and invest. This would be a valuable tool to attack the system as the federation would mask any coordination and provides plenty of opportunity to create puppet accounts to funnel money into the system.